PREV ARTICLE

NEXT ARTICLE

FULL ISSUE

PREV FULL ISSUE

ROBERT KORVER ON POST-AUCTION PURCHASES

Earlier this month Bob Korver published several new articles and presentations on his web site, NumiStorica.com. One of these relates to

the age-old practice of reserve prices at auction. -Editor

You must understand that the prevailing mentality at Heritage -- and at every other auction firm -- was that we DID NOT like Reserve bids. We were in business to auction coins, not to return them to a consignor because he or she thinks they are worth more than EVERY OTHER numismatist in the universe. We had, on occasion, sold a lot after an auction to a bidder who, say, had a flat tire on the way and missed his lot (which hadn't sold) but the standard rule was "WE HOLD ONLY ONE AUCTION!" On to the heart of the story. After the last lot sold, a bidder I recognized as successful came up to the Podium with a sad story. While he had successfully bid on $10,000 in Standing Liberty quarters, he had been saving the bulk of his wallet to bid on an extraordinary 1927-S in MS66; unfortunately (for him) it went for thousands more than his absolute top bid. Then he said the magic words to me: "I have another twenty-five thousand dollars to spend, and I let any number of quarters sell to their reserves rather than chase them. Can I buy some of those now?" Did I mention I was tired? I asked the auctioneer if he would stay for another 15 minutes (redoing all the paperwork really took two people). Did I mention he was exhausted as well? He looked at the bidder, and decided that he didn’t need a new NBF (Numismatic Best Friend). "WE PREFER TO HOLD ONLY ONE AUCTION", he sniffed, and walked out of the room. Perhaps to bed, perchance to dream. I had noticed during the auction that this entire run of Quarters had been reserved by the consignor, and several did not sell. I asked my 'Second Auction' bidder how much more he wanted to spend, hoping he would give me a small number that would allow me to scamper to my Number Running as well. He said "ALL OF IT." And that was the moment of epiphany -- well, that and about 5 seconds of quick calculations. At that time, the average consignor probably paid about a 3% Reserve Fee. This varied widely of course, but during my three seconds, I figured 3% was close enough. All of our production costs, as I well knew from my position of Auction Director at Heritage, were sunk. Catalogers were paid, photographers were paid, graphic artists were paid, printers were paid, the Post Office had been paid. If I sold $10,000 of buybacks to my new NBF, the company would earn his 10% buyers fee PLUS a 5% Sellers Fee. In short, a little more than 12% (it's more because the 15% is on an increment or half-increment higher than the 3% Reserve amount. On $10,000 in extra sales, the company would earn more than $1,200 — times two — of pure profit. Not bad for 15-30 minutes of paperwork. So I stayed, and my NBF bought every reserved lot still available to him: 4 coins, for $26,125. For my 30 minutes of work, I made one bidder happier (he got to empty his wallet); one consignor happier (he got a check for $25k more), and Steve Ivy happier, as his prices realized were higher, sell-through rates were higher, and Heritage Numismatic Auctions earned an additional $3,135. Besides, I wasn't going to be sleeping anyway. And, I say this: my NBF did it right. He didn’t dither, he didn’t discuss, he BOUGHT — and he bought them all! That's how to impress me, even after the point of exhaustion. I like bidders who know what they want, and I like PURE PROFIT! That ANA was successful. But on the flight home, I thought about the $2 million-plus in buybacks, and wondered just how much of that could be converted from 3% to 15% revenue generation by reaching out to 7,500 bidders, instead of just one! It took me more than a year to convince the Executives that "We prefer to hold only one auction", while a good policy, and time tested, it was not the Holy Grail. And the new policy had the advantage of differentiating Heritage from all other auctioneers, an important marketing strength: WE NEVER STOP TRYING TO SELL YOUR COINS. Bottom line, happier consignors and happier bidders. How much happier? When I stopped counting several years ago, Heritage had already sold more than $250 million through its Post Auction Buys, and that is a whole lot of happiness for all parties concerned. Especially Heritage, earning more than 10% on that with but the smallest of additional programming expenses. Incidentally, the fear (often expressed before implementation) that the new policy would reduce auction proceeds (because bidders would wait until after the auction to chase reserved lots) did not come true; quite to the contrary. Knowing that ALL reserved lots would be made available to thousands of bidders afterwards motivated Heritage's clients to bid and buy during the first auction. Now, it seems the initial bidders prefer to hold just one auction...

As for those reserved headline Pogue IV coins, I'm sure they'll find new homes someday, perhaps sooner rather than later. -Editor

To read the complete article, see:

Archives International Auctions, Part XXXIII Chinese, Asian &Worldwide Banknotes, and Chinese Scripophily June 28, 2016

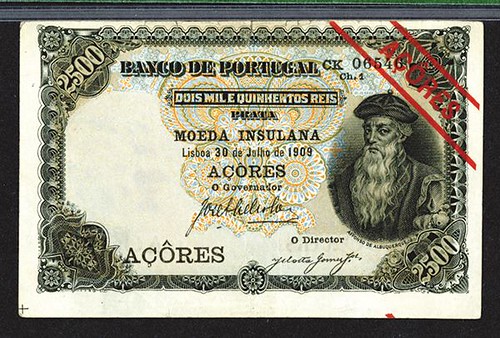

Click the links! Highlights include: Lot 198: American-Oriental Banking Corporation, 1919 “Shanghai Branch” Lot 245: Dah Chon Chang Money Exchange, ca.1920's "Shanghai" Lot 315: Republik Indonesia Unlisted 1948 Issue Essay Specimen Lot 451: Banco de Portugal - Azores. 1909 Issue Lot 475: Imperial Do Brazil (1882) Issue Color Trial Essay Proof Lot 700: Comite Bancario de Guatemala. 1899 Issue Lot 889: Bank of Rhodesia & Nyasaland. 1960 Issue. Lot 1006: Central Bank of Turkey. 1930 Law Issue View the Virtual Catalog Download the Catalog in PDF format ARCHIVES INTERNATIONAL AUCTIONS, LLC 1580 Lemoine Avenue, Suite #7 Fort Lee, NJ 07024 Phone: 201-944-4800 Email: info@archivesinternational.com WWW.ARCHIVESINTERNATIONAL.COM Wayne Homren, Editor The Numismatic Bibliomania Society is a non-profit organization promoting numismatic literature. See our web site at coinbooks.org. To submit items for publication in The E-Sylum, write to the Editor at this address: whomren@gmail.com To subscribe go to: https://my.binhost.com/lists/listinfo/esylum All Rights Reserved. NBS Home Page Contact the NBS webmaster

|