PREV ARTICLE

NEXT ARTICLE

FULL ISSUE

PREV FULL ISSUE

GAO STUDIES BENEFITS OF REPLACING DOLLAR BILLThe U.S. Government Accountability Office (GAO) issued a report last month on the financial benefit of switching to a $1 coin. The results were not what one might expect. Thanks to Pabitra Saha for passing this along. -Editor

What GAO Found

Why GAO Did This Study

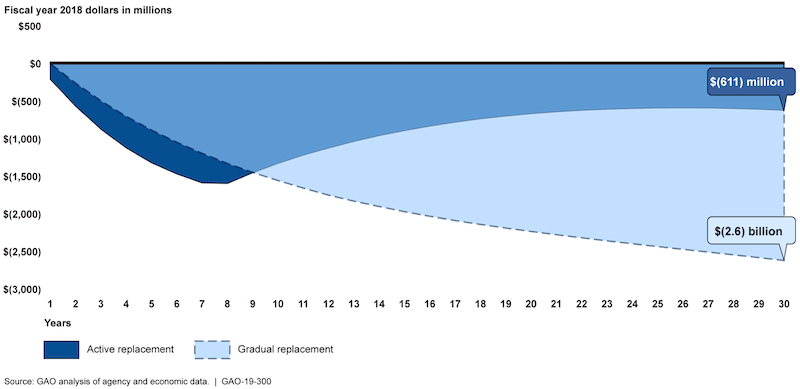

GAO was asked to examine the potential cost savings to the government from making changes to currency. This report (1) estimates the net benefit to the government, if any, of replacing the $1 note with a $1 coin and selected stakeholders' views on this change; and (2) examines what is known about potential cost savings from suspending penny production and changing the metal composition of the nickel, and selected stakeholders' views on these changes. GAO conducted economic simulations of continued use of $1 notes and replacing notes with $1 coins, examined cost data from the U.S. Mint, and interviewed officials from the Federal Reserve, U.S. Mint and Bureau of Engraving and Printing as well as 10 selected stakeholders representing industries that could potentially be affected by currency changes. What GAO Recommends

It's a lengthy report, but interesting reading nonetheless. There is a response from U.S. Mint Director David Ryder included as an appendix. -Editor

To read the complete article, see:

Rich Bottles Jr. forwarded an article about the report, noting: "It seems that dollar bills are lasting longer as US consumers move more toward cashless purchases, thus eliminating any cost savings by switching solely to dollar coins." -Editor

GAO said that while it has found in the past that use of a coin would save money, times have changed. The difference today is largely due to the longer life span of dollar bills that didn't used to exist: Due to this substantially longer note lifespan, fewer $1 notes need to be produced over a 30-year period, which reduces the cost of producing them and diminishes the relative advantage of the long coin life. In our 2011 simulations, a $1 coin was assumed to last about 10 times as long as a $1 note (34 years to 3.3 years); in our current simulations, the lifespan of the coin remains the same but is now only about 4.3 times as long as that of the note (34 years to 7.9 years). Meanwhile, the relative cost of producing coins and notes has remained about the same.

The Federal Reserve has improved its process of producing dollar bills which makes them last longer and also results in having to produce fewer of them which ultimately lowers costs. To read the complete article, see:

Wayne Homren, Editor The Numismatic Bibliomania Society is a non-profit organization promoting numismatic literature. See our web site at coinbooks.org. To submit items for publication in The E-Sylum, write to the Editor at this address: whomren@gmail.com To subscribe go to: https://my.binhost.com/lists/listinfo/esylum All Rights Reserved. NBS Home Page Contact the NBS webmaster

|