PREV ARTICLE

NEXT ARTICLE

FULL ISSUE

PREV FULL ISSUE

MAGGIE LENA WALKER'S SAVINGS BANKA September 25, 2020 Wall Street Journal article profiles Maggie Lena Walker, the first Black woman to run a U.S. bank. -Editor

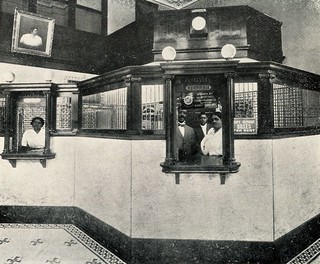

The daughter of a former slave, Walker became the first Black woman ever to head a U.S. bank when she founded the St. Luke Penny Savings Bank in Richmond, Va., in 1903. Her success came from doing what great entrepreneurs do: Walker zeroed in on an underserved market and focused her prodigious energy on meeting its needs. Walker had worked as an insurance agent and had taken correspondence courses in business and accounting, where the color of her skin wouldn't disqualify her from participating. The manager of one white bank in Richmond allowed Walker to spend several hours a week there for months, studying how banking worked down to the finest details. At the time, many white banks refused to lend to Black borrowers. Those that did often charged higher rates, creating resentment and further hardship that drove borrowers to pawnbrokers, payday lenders and loan sharks. In 1865, Congress created the Freedman's Savings & Trust Co. to serve formerly enslaved people. In 1874, the bank's corrupt and incompetent white managers ran it into the ground. Most depositors reclaimed no more than 60% of their money; many lost everything.

Walker knew impoverished borrowers could be honest and diligent. So she turned local communities into ad hoc credit committees, enabling St. Luke to lend to borrowers with trustworthy references. By the 1920s, at least 100 Black women worked at St. Luke's enterprises, probably more than at any other organization in the U.S. financial industry, according to Prof. Garrett-Scott. In 1930, St. Luke absorbed two smaller Black banks in Richmond to become Consolidated Bank and Trust Co., which Walker shrewdly steered through the hardest years of the Great Depression. In 2009, its holding company was acquired by what is now Huntington, W.Va.–based Premier Financial Bancorp. Inc.

To read the complete article (subscription required), see:

To read an earlier E-Sylum article, see:

Wayne Homren, Editor The Numismatic Bibliomania Society is a non-profit organization promoting numismatic literature. See our web site at coinbooks.org. To submit items for publication in The E-Sylum, write to the Editor at this address: whomren@gmail.com To subscribe go to: https://my.binhost.com/lists/listinfo/esylum All Rights Reserved. NBS Home Page Contact the NBS webmaster

|