PREV ARTICLE

NEXT ARTICLE

FULL ISSUE

PREV FULL ISSUE

MORE ON NON-FUNGIBLE TOKENSWhen I first saw the news article about the basketball platform Top Shot, I thought it would make a great "decoy" article for last week's April Fool E-Sylum issue - something true, but so out-there-sounding, that people would think it's a joke. But I guess nothing fazes people anymore. Non-Fungible Tokens (NFTs) may or may not be here to stay, but they're certainly the craze of the moment. NFTs or something like them may well eventually worm their way into the numismatic world. -Editor Joel Orosz writes: "I had not heard of NFTs before, and I must confess that I am among those chowderheads who just don't get it. Blockchain technology guarantees that you own an authentic, albeit virtual, video clip that can be viewed for free on the Internet. Wouldn't this be like paying $208,000 to virtually own Pledges of History, which can be viewed for free on NNP? I paid less than 1% of that to own two differently-inscribed copies of the same book. I didn't get blockchain verification straight back to 1846, however, so perhaps I was literally taken for a ride by not having two virtual books blockchain-backed instead of two literally signed-by-the-author ones. " Kavan Ratnatunga writes: "The Token can be programmed to give the original creator a commission, if and when the digital art is resold." Correct. In addition to authenticating ownership, the token can embed contract terms for future resales. This comes from the original concept of enabling the original creator to profit from future sales of their work. It's like a covenant on a deed. Of course, if you don't agree to that covenant, don't buy the item, or don't pay as much as you would otherwise. Here are some article links courtesy Kavan, Martin Kaplan, and myself. -Editor For more information, see:

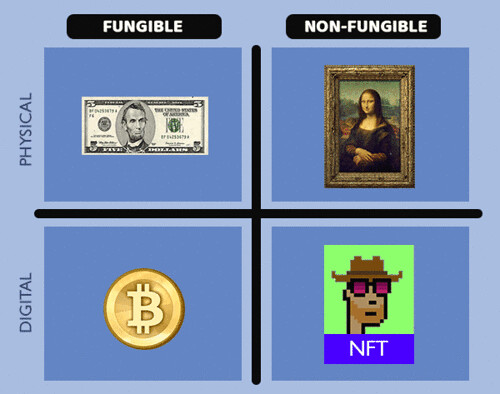

Here's a lengthy excerpt from a great New York Times article about NFTs by Kara Swisher. -Editor For those scratching their heads about the latest tech phenom called non-fungible tokens, or NFTs, I have one simple sentence to explain it all: Everything that can be digitized will be digitized. It was the same explanation I gave as the internet first went commercial in the early 1990s, when I started writing about the nascent medium. I was often asked the same questions by people who often thought of it as a fad: What exactly was on the internet? And why would I use it? Everything, I answered, to the first question. All knowledge. All communications. All entertainment. All movies. All commerce. To the second question, well, my answer was usually: Whatever. With NFTs, we've come yet another step closer to fully digitizing our lives. Like the internet, they are complex, but in the simplest terms, they are digital files that are stored using a technology called blockchain, which is essentially a digital ledger. But unlike cryptocurrencies, including the well-known Bitcoin, NFTs are not interchangeable with one another, because of their unique digital assets as well as important digital authentication that marks ownership. The easiest analog comparison many make is to baseball cards, some of which are valuable and some not. Anything that someone might find valuable that can be digitized can become an NFT — and be sold in any of the many crypto marketplaces. This includes video clips of sports events, tweets to photos and even things like rights to front-row seats at concerts. NFTs have shown their utility most prominently recently in the art world, where people are paying enormous sums for the rights to "own" things, like a one-of-a-kind GIF of the famous Nyan Cat or a whimsical and often puerile collection of digital art images made by a popular graphic designer named Mike Winkelmann, who goes by Beeple. "It's a blank slate" is how Beeple described NFTs to me in an interview, never mind that bizarre images of a naked Elon Musk and a lactating Donald Trump, which have driven art critics crazy, are how he has chosen to fill his. And that's pretty much all you need to know, since you can pour anything of value into an NFT — even assets linked to the real world like houses and cars — and it will be worth whatever it is worth, which has always been whatever someone is willing to pay to acquire it. Most important, it is verified and transparent. It's also the obvious next step as our world becomes ever more virtual. This irresistible trend has accelerated with great speed over the course of the pandemic, which has forced us to work online, play online, watch online, talk online, exercise online and learn online more than ever before. And that behavior is simply not going to let up. So, repeat after me: Everything that can be digitized will be digitized. And it will happen before you know it. To read the complete article, see:

Some of those sky-high prices are already slipping... -Editor Prices for digital collectibles like art and sports memorabilia are sliding, turning the focus back on whether the nascent market for so-called non-fungible tokens is any more than a fleeting mania. Average prices for NFTs -- essentially tradable digital certificates that use blockchain technology to prove ownership and provenance of online assets -- have tumbled almost 70% from a peak in February to about $1,400, according to Nonfungible.com, which tracks a variety of NFT marketplaces. A burst of interest in NFTs hit a peak last month when a digital artwork by Beeple sold for a staggering $69.3 million. For some, that sum showed NFTs were in the grip of investor excess in a world full of stimulus, and destined to fizzle. Others who study the technology argue the use of blockchain to create scarcity for digital collectibles is a lasting innovation rather than a price fad. "It's not meaningful to characterize a concept as a financial bubble," said Chris Wilmer, a University of Pittsburgh academic who co-edits a blockchain research journal. "'NFTs' aren't in a bubble any more than 'cryptocurrency' is a bubble. There will be manias and irrational exuberance, but cryptocurrency is clearly here to stay with us for the long term and NFTs probably are too." "The interest in building a persona -- and owning things -- in the digital world has been bubbling up for years," said Berna Bershay, an analyst at Empire Financial Research. "With so much time spent online in the past year, the desire to own digital assets was probably dragged several years forward by the Covid-19 crisis." To read the complete article, see:

This piece from The Atlantic provides a perspective from one of NFT's creators. -Editor

The idea behind NFTs was, and is, profound. Technology should be enabling artists to exercise control over their work, to more easily sell it, to more strongly protect against others appropriating it without permission. By devising the technology specifically for artistic use, McCoy and I hoped we might prevent it from becoming yet another method of exploiting creative professionals. But nothing went the way it was supposed to. Our dream of empowering artists hasn't yet come true, but it has yielded a lot of commercially exploitable hype. If you liked an artwork, would you pay more for it just because someone included its name in a spreadsheet? I probably wouldn't. But once you leave aside the technical details of NFTs, putting artworks on the blockchain is like listing them in an auction catalog. It adds a measure of certainty about the work being considered. By default, copies of a digital image or video are perfect replicas—indistinguishable from the original down to its bits and bytes. Being able to separate an artist's initial creation from mere copies confers power, and in 2014 it was genuinely new. Our initial NFT demo in 2014 was so well received that McCoy and I were invited to present the tech again a week or two later—this time at TechCrunch Disrupt NY, one of the technology industry's highest-profile conferences. The crowd was a mix of tech geeks and corporate types, all eager to spot the next hot start-up or popular smartphone app. McCoy and I gave a slightly more polished demo of how our proto-NFTs could help artists. Just like at the art museum, we made fun of our own phrase, monetized graphics. This time, nobody in the audience laughed. In the tech world, monetizing innovations is no joke. It's how the industry operates, and this crowd was all business. But the NFT prototype we created in a one-night hackathon had some shortcomings. You couldn't store the actual digital artwork in a blockchain; because of technical limits, records in most blockchains are too small to hold an entire image. Many people suggested that rather than trying to shoehorn the whole artwork into the blockchain, one could just include the web address of an image, or perhaps a mathematical compression of the work, and use it to reference the artwork elsewhere. We took that shortcut because we were running out of time. Seven years later, all of today's popular NFT platforms still use the same shortcut. This means that when someone buys an NFT, they're not buying the actual digital artwork; they're buying a link to it. And worse, they're buying a link that, in many cases, lives on the website of a new start-up that's likely to fail within a few years. Decades from now, how will anyone verify whether the linked artwork is the original? All common NFT platforms today share some of these weaknesses. They still depend on one company staying in business to verify your art. They still depend on the old-fashioned pre-blockchain internet, where an artwork would suddenly vanish if someone forgot to renew a domain name. "Right now NFTs are built on an absolute house of cards constructed by the people selling them," the software engineer Jonty Wareing recently wrote on Twitter. Meanwhile, most of the start-ups and platforms used to sell NFTs today are no more innovative than any random website selling posters.

To read the complete article, see:

Here's an excerpt from Jeff Garrett's article om the topic. -Editor For several years now, I have joked that people know so little about Bitcoin that they ask my thoughts on it because I'm a coin dealer. In general, most individuals that I speak with consider Bitcoin to be a speculative bubble waiting to pop. The recent rise of Non-Fungible Tokens (NFTs) is making peoples' heads spin, but the future of NFTs is up in the air until the tokens become more widely accepted and understood as an asset class. Many of you are probably wondering what any of this has to do with the rare coin market. My guess is, probably more than most of us realize. Most large Wall Street firms have created departments for cryptocurrency investments, and many large corporations now park excess funds in Bitcoin instead of in gold or foreign exchange. Elon Musk recently invested more than $1 billion in Bitcoin for Tesla. Bitcoin is outshining gold, and the flow of capital proves this: follow the money. The NFTs phenomenon is another matter. Many people in the rare coin industry are trying to figure out if there could be a play in this space. My expertise and understanding of the NFT markets is limited, but I do know the technology is based on blockchain and the security it provides. Artists and players in the art market are extremely excited by the possibilities NFTs might offer those who seek to retain some rights in future sales of their works. Perhaps this could be applied to rare coins in some way. The fractional sale of mega-coins or collections could be another possibility. Who wouldn't want part ownership of the 1787 Brasher Doubloon graded NGC MS 65 that recently sold for $9.36 million? This new way of looking at rare coin investing could bring in giant sums and attract a much younger demographic.

To read the complete article, see:

So what will the idea morph into in the future? I agree that it's a powerful idea, to both reliably authenticate ownership and perpetuate contracts into the future, returning some compensation to the original creators or their successors. Great for starving artists and their families, but also a great way for the rich to get richer and richer for ever and ever. What if Vincent Van Gogh (or a trust in his name) continued to collect a portion of the proceeds every time one of his artworks were resold? What if I could claim a portion of the proceeds every time one of the coins in my collection today trades hands again in the future? -Editor

To read the earlier E-Sylum article, see:

Wayne Homren, Editor The Numismatic Bibliomania Society is a non-profit organization promoting numismatic literature. See our web site at coinbooks.org. To submit items for publication in The E-Sylum, write to the Editor at this address: whomren@gmail.com To subscribe go to: https://my.binhost.com/lists/listinfo/esylum All Rights Reserved. NBS Home Page Contact the NBS webmaster

|