PREV ARTICLE

NEXT ARTICLE

FULL ISSUE

PREV FULL ISSUE

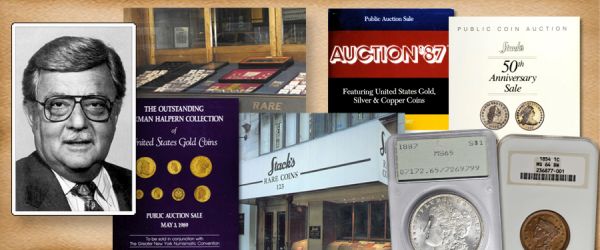

HARVEY STACK'S NUMISMATIC FAMILY, PART 105The latest article in Harvey Stack's blog series covers a 1989 debate over the licensing of professional coin dealers. -Editor

There were all kinds of scams, including instructing people to not open coin rolls or mint-sealed boxes or bags, as that would reduce the value. In this way customers could be ripped off by the inclusion of fake or low-grade coins that were only discovered if the roll or bag was opened. These were all concerns of the FTC, the Treasury Department/Secret Service, and the Security and Exchange Commission (SEC). From 1985 through 1989 the FTC apprehended some of these scam artists, arrested them, brought them to trial and fined them huge sums. It was these offenses, along with misleading public advertising and various promotions that caused the FTC to seek a licensing requirement for all who bought and sold gold, treating coin dealers the same as they would proprietors of a pawn or hock shop. The FTC's Barry Cutler wanted to have this forum or debate to hear from the Professional Numismatists Guild, Luis Vigdor, and myself about how to start the procedure and what the possible damage was for a "basically good industry." Luis Vigdor, who was a senior officer of Manfra, Tordella and Brooks (MTB), reviewed in detail the buying and selling of gold coins by his and most established companies. He confirmed that their staff could readily recognize the counterfeits and often shared their findings with the Secret Service. MTB also ran a daily "buy and sell" operation, as gold, like other precious metals had to be treated like other commodities, where the buy price is a small fraction below the sell price. If a small coin dealer, a Mom and Pop operation, or a small local jeweler was treated like a pawn shop, they would have to verify the seller's identity, report the "buy" to the local authorities (as is required by a second-hand dealer's license in most cities and state) and would have to hold the coins for 30 days. Those who did not have enough capital could not afford to hold these items that long and could lose what they had invested. Since coins do not have a serial number or other special I.D., identifying stolen property would be virtually impossible. The suggested regulations could very well close many small coin shops, and have a detrimental effect, even on large coin dealerships. After Luis Vigdor's explanation about the running of a precious metal and rare coin business he turned the floor over to me.?

To read the complete article, see:

To read the earlier E-Sylum article, see:

Wayne Homren, Editor The Numismatic Bibliomania Society is a non-profit organization promoting numismatic literature. See our web site at coinbooks.org. To submit items for publication in The E-Sylum, write to the Editor at this address: whomren@gmail.com To subscribe go to: https://my.binhost.com/lists/listinfo/esylum All Rights Reserved. NBS Home Page Contact the NBS webmaster

|