PREV ARTICLE

NEXT ARTICLE

FULL ISSUE

PREV FULL ISSUE

CLEARING HOUSE CERTIFICATES AND THE PANIC OF 1907

Pablo Hoffman recommended the Delancey Place newsletter a while ago, and I signed up immediately. It's a daily email with an

excerpt or quote from a non-fiction work, primarily historical in focus. They're often a delight to read. Although the topics are

only occasionally related to numismatics, when they do they're spot-on. This item from January 25, 2016 is an excerpt about the Panic

of 1907 from America's Bank: The Epic Struggle to Create the Federal Reserve by Roger Lowenstein, 2015 [pages 65-68]. -Editor

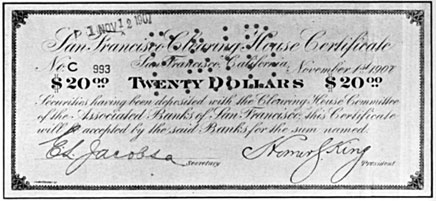

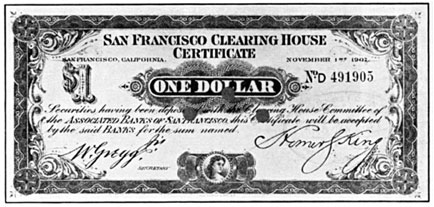

"With panic spreading, clearinghouses and bank associations in scores of other cities minted their own versions of clearinghouse money. Some were elaborately engraved to give the appearance of normal currency. The certificates were intended to be used only among banks, so that cash could be preserved for ordinary depositors. In a crude way, they added to the money supply -- later a function of the Federal Reserve. However, in more than a score of cities banks were forced to hand out loan certificates not just to their fellow banks, but to ordinary depositors. "Many railroads, mining companies, and shopkeepers paid workers with bank checks instead of with cash; those that didn't had little choice but to suspend operations. In Birmingham, Alabama, banks distributed checks signed by their cashiers in denominations as small as one dollar to local employers -- who used this scrip to pay their workers. Retail establishments generally accepted such paper, since that was all that many customers had.

"By mid-November, approximately half of the country's larger cities were using loan certificates 'or other substitutes for legal money,' according to a survey conducted just after the Panic by Harvard's Professor Piatt Andrew. Loan certificates had been used in previous panics, but never so extensively. In some smaller towns where no clearinghouse existed, the local bankers improvised, setting up a temporary committee, as it were, on the front porch. Bankers tried to reassure the public, noting that certificates were backed by 'approved securities.' Some added piquant details. In Portland, Oregon, the clearinghouse boasted that banks had deposited notes secured by 'wheat, grain, canned fish, lumber . . . and other marketable products.' Monetary exchange was reverting toward barter. "Andrew estimated that $500 million of cash substitutes of one form or another were circulated nationwide. And in two-thirds of cities with populations above 25,000, banks suspended cash withdrawals 'to a greater or less degree.' For example, in Council Bluffs, Iowa, a limit was imposed of $10 per customer; in Atlanta, $50 per day and $100 per week. Banks in Providence, Rhode Island, adopted a convenient policy of 'discretion,' vetting withdrawals case by case. Although such actions had scant legal footing, officials not only looked the other way, in many states they encouraged banks, for their own protection, to curtail teller operations. Bank holidays were proclaimed in a handful of states, with California's enduring until late December. Small wonder that Andrew termed it 'the most extensive and prolonged breakdown' of the credit system since the Civil War."

Clearing House certificates are one of my favorite collecting areas. Until the 2013 book by Neil Shafer and Tom Sheehan it was an

uncharted area, which made the prospecting fun. -Editor

To read the complete article, see:

For more information on the Panic Scrip book, see:

THE BOOK BAZARREWayne Homren, Editor The Numismatic Bibliomania Society is a non-profit organization promoting numismatic literature. See our web site at coinbooks.org. To submit items for publication in The E-Sylum, write to the Editor at this address: whomren@gmail.com To subscribe go to: https://my.binhost.com/lists/listinfo/esylum All Rights Reserved. NBS Home Page Contact the NBS webmaster

|