PREV ARTICLE

NEXT ARTICLE

FULL ISSUE

PREV FULL ISSUE

BLACK MARKET PRICE OF €500 NOTE COULD RISE

Last week we discussed the planned discontinuance of the €500 note. A Wall Street Journal notes that this action could drive the

value of existing €500 notes beyond face value. -Editor

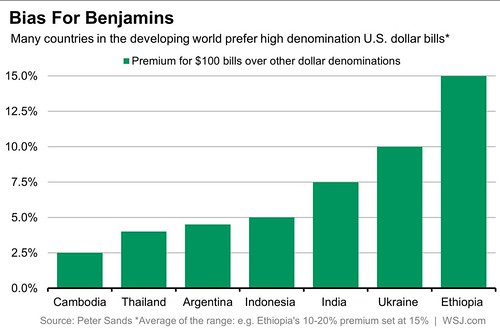

The ECB said on Wednesday that it will stop printing a note that police agencies say is a preferred tool for international criminals. But like pop stars and painters, the value of these notes may increase in death. Some of the ECB's senior policymakers didn't like the idea of getting rid of the note entirely. So while new €500 notes won't be printed any more, they will remain legal tender. Typically, when a central bank stops producing a denomination or a series of banknotes, it offers a fixed period in which it will still be accepted as legitimate currency. For example, a British £20 note bearing the image of Edward Elgar was issued from 1999, ceased production in 2007 and stopped being legal tender in 2010. In the eurozone, national central banks will still exchange their old currencies, from the franc to guilder, for euros. But they can no longer legally be used purchase goods and services. Restricting the supply of the €500 note could actually result in this note, one of the largest in major economies, trading at a premium to other euro denominations. Even before the decision, there were reports that this was happening. In 2015, Europe's umbrella organization for policing, Europol, warned that law enforcement agents had informed them that €500 notes trade hands at above their face value in the criminal world, “so important is their role in cash transportation for money laundering.” And that phenomenon is not unique to Europe. The highest U.S. dollar denomination, the $100 bill, trades at a significant premium in many emerging markets. That's according to Peter Sands, the former CEO of Standard Charted who sparked the discussion over high denomination banknotes earlier this year. Argentina, Ethiopia, Indonesia and India are among the countries where buyers will stump up more of their local currency to get hold of $100 notes, paying between 2% and 20% more for the highest denomination, Mr. Sands said.

Though the idea seems odd, history shows that notes of the same ostensible value can trade at a premium to others. Before the U.S. National Bank Act in 1863, many U.S. dollar notes were issued by private banks. The notes were traded at values based on how creditworthy the bank was regarded. In much of the country, and particularly during banking panics, that made some dollars worth more than others.

Looks like a classic arbitrage opportunity, although local laws, officials and criminals could all get in the way. I suspect flying to

Ethiopia with stacks of $100 bills may not be worth the $15 apiece you could get in exchange for lower denomination notes. Still, if

you're going anyway to one of these places why not pack a few larger bills to stretch your travel budget?

Congrats to the WSJ for noting the historical range of values for circulating banknotes in the U.S. -Editor To read the complete article, see:

To read the earlier E-Sylum article, see:

Wayne Homren, Editor The Numismatic Bibliomania Society is a non-profit organization promoting numismatic literature. See our web site at coinbooks.org. To submit items for publication in The E-Sylum, write to the Editor at this address: whomren@gmail.com To subscribe go to: https://my.binhost.com/lists/listinfo/esylum All Rights Reserved. NBS Home Page Contact the NBS webmaster

|